Do industrial mill manufacturers pay land use tax

Manufacturing Sales and Use Tax Considerations Wolters Kluwer

2018年3月12日 In most states, sales and use taxes are imposed on the sale of all tangible personal property and certain enumerated services unless specifically exempt from this tax by statute Full and partial exemptions from sales and use taxes are available to qualified Under Iowa Code section 4233(48), the services of design and installation of new industrial machinery and equipment for sale or rent are exempt from sales tax if industrial machinery Iowa Sales and Use Tax on Manufacturing and ProcessingUse tax considerations are relevant across four areas for manufacturers: machinery and equipment, RD, interplant transfers and inventory withdrawals — with the last one pertaining Tax Accounting Use Tax for Manufacturers and Distributors2009年5月14日 from sales and use taxes from the sale, furnishing, or service of gas including bottled gas and electricity when delivered to consumers through mains, lines, pipes, or bottles IP 2009(13), Sales and Use Taxes Guide for Manufacturers,

.jpg)

Navigating Sales Tax Exemptions in Manufacturing

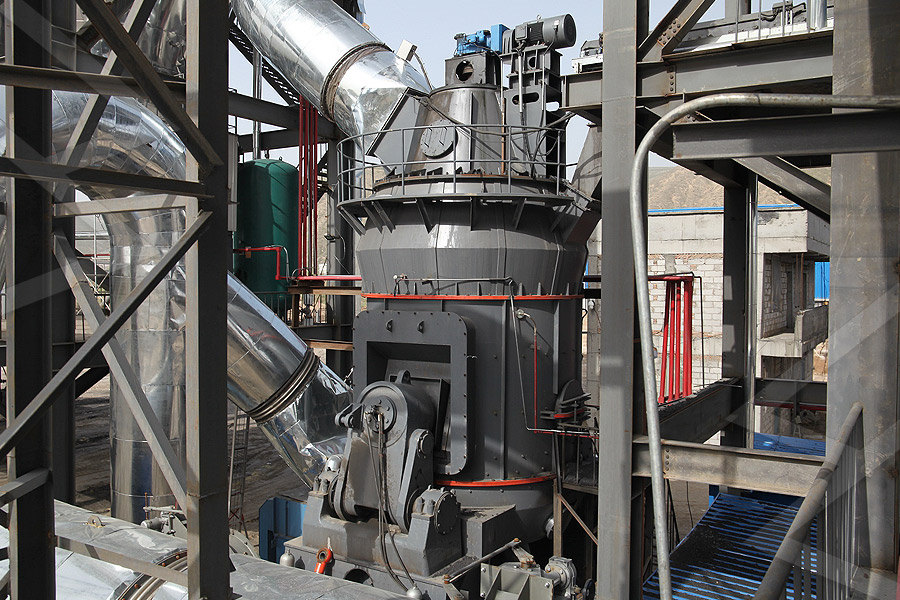

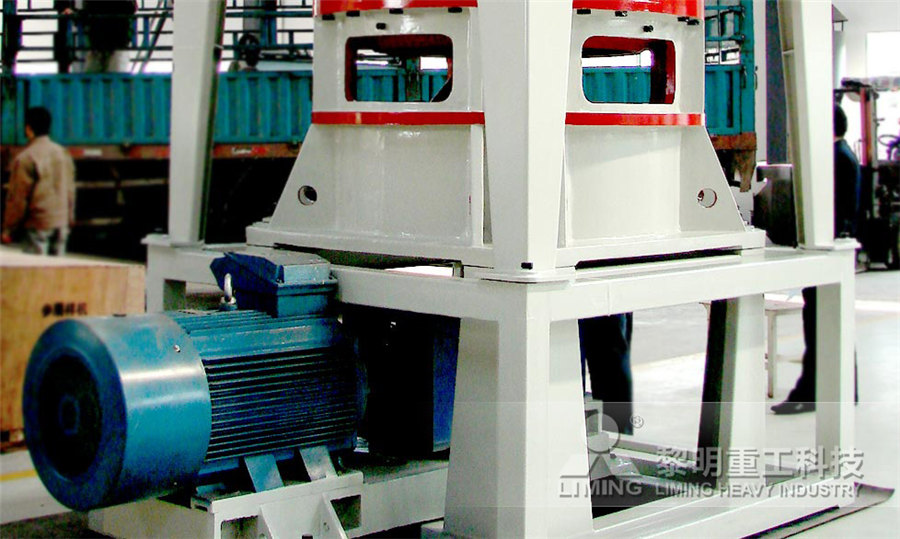

2024年1月11日 Its Sales Use Tax Technical Bulletin 572 explicitly states that “sales of mill machinery or mill machinery parts or accessories to be used in the production processto [a Mill (generally manufacturing) machinery, including parts or accessories as well as specialized equipment for loading or processing, is exempt from sales and use tax For a list of items that Manufacturing EDPNC2012年5月29日 Of the 45 states that impose sales and use tax on sales of tangible personal property, most provide an exemption or reduced rate for companies that operate as Does Your Company Qualify as a Manufacturer for Sales and Use 2018年8月21日 Manufacturers often encounter scenarios where items purchased for exempt purposes end up being used differently, triggering the need for use tax payments This blog Use Tax for Manufacturers Sales Tax DataLINK

China's Current Tax System Urban and Township Land Use Tax

2024年2月21日 The taxpayers of Urban and Township Land Use Tax include all enterprises, units, individual household businesses and other individuals who have landuse right For example, a printing company may use the reproduction equipment to copy office records Even though divergent use occurs, the manufacturer can issue a valid exemption for qualifying equipment But the manufacturer must pay tax on the nonexempt use of the equipment For equipment purchased four or more years ago, there's no tax on divergent useTEXAS SALES AND USE TAX EXEMPTIONS: MANUFACTURING 2019年2月16日 Regulation 1525 Property Used in Manufacturing Reference: Sections 6007–60091, Revenue and Taxation Code (a) Tax applies to the sale of tangible personal property to persons who purchase it for the purpose of Sales and Use Tax Regulations Article 3 California 2022年10月19日 Details on how California sales tax applies to manufacturers, including paying sales tax on purchased materials and available exemptions Skip to Content Call Us Today! 8664587966 Home; On the front end, you may need to pay sales tax on the purchased items you use to further your manufacturing businessCalifornia Sales Tax for Manufacturers and Producers

.jpg)

Manufacturer's sales/use tax exemption for machinery and

Generally, a business must report under one or more of the manufacturing BO tax classifications to be eligible for the manufacturer’s sales and use tax exemption Other requirements apply Manufacturer's sales/use tax exemption for machinery and equipment (ME) Washington Department of RevenueContributor: Taylor Atwood, CMI, Manager, Sales Use Tax Most states offer a variety of sales tax exemptions to manufacturers as incentives for companies to locate and keep plants in their states However, not all purchases used by manufacturers are exempt from tax, and many items only qualify for exemptions if they meet specific requirementsFive Hot Spots for Manufacturing Sales Tax ExemptionsSales Use Tax Topics: Manufacturing 2 Revised February 2024 Items withdrawn from inventory In general, when a manufacturer withdraws from its inventory a fully or partially manufactured item for the manufacturer’s own use, the manufacturer Sales Use Tax Topics: Manufacturing Department of RevenueInput Item Taxability, Use Tax, and Direct Pay Permits; Drop Shipping on Behalf of a Distributor or Retailer by a Manufacturer; Installation, Repairs, and Nexus; As an alternative, many states allow manufacturers to use “Direct Pay Permits” to allow a manufacturer to make purchases without paying sales taxSales tax and use tax for manufacturers and distributors

Tax Guide for Manufacturing, and Research Development, and

As of July 1, 2014, manufacturers and certain research and developers, and as of January 1, 2018, certain electric power generators and distributors, may qualify for a partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and development, and electric power generation or production, 2019年2月25日 Another significant part of the Florida sales and use tax exemption provided to manufacturers can be found in Florida Statute §21208(7)(xx), which states that repair and labor charges for exempt industrial machinery and equipment are also exempt from sales taxThis includes all labor charges for repairs and maintenance as well as any parts or materials used Florida Manufacturing Use Tax Exemption Agile ConsultingIndiana manufacturers are also able to recover taxes erroneously paid to their suppliers or selfassessed on their use tax returns as part of the Indiana sales tax exemptions for manufacturing The state of Indiana has a statute of limitations that enables manufacturers to go back and recover sales tax refunds up to three years, or 36 months, from when the Indiana sales or use Indiana Sales Tax Exemption for Manufacturing2018年8月21日 If you didn’t pay the tax as sales tax, however, you will still owe it as use tax Individual consumers usually don’t bother to calculate and file use tax States know that enforcing use tax for individual consumers isn’t practical Use Tax for Manufacturers Sales Tax DataLINK

Manufacturing – Florida Sales and Use Tax Exemption

2019年8月23日 Florida offers some amazing sales and use tax exemptions for manufacturers, Read this article to learn more on how you client or your company many be due sales and use tax refunds! Skip to Content Call Us Manufacturing Sales Tax Exemption James Costigan, Tax Auditor Agent Dara Greene, Attorney, Tax Appeals Division Agenda • I Manufacturing Exemption Overview • Manufacturer is defined as “a person who is engaged in manufacturing, processing, assembling or refining a product for sale and, solely for the purposes of division (B) Understanding the Manufacturing Sales Tax Exemption Cloudinary2018年3月12日 Retail companies are getting most of the attention these days, and rightfully so, especially with the US Supreme Court review of its 1992 Quill nexus physical presence decision hanging over their heads like the sword of DamoclesHowever, the sales and use tax issues of companies in other key industries–manufacturers, wholesalers and distributors, information Manufacturing Sales and Use Tax Considerations Wolters Use Tax and Manufacturers Use Tax and Manufacturers Manufacturers like all other taxpayers owe use tax on their untaxed purchases of tangible personal prop To register to pay the Use Tax, phone (888) 4054089 For general questions regarding Use Tax, phone (888)4054039Use tax and manufacturers Cloudinary

.jpg)

Manufacturing EDPNC

North Carolina does not levy a sales and use tax on repairs to industrial machinery or service contracts for mill machinery Electricity, Fuel and Natural Gas, Sales and Use Tax Exemption Retail sales, as well as the use, storage or consumption of electricity, fuel and piped natural gas sold to a manufacturer are exempt from sales and use tax for use in a manufacturing operationBusinesses must register each location to collect, report and pay sales tax You can register using the online registration system or submit a paper Florida Business Tax Application (Form DR1 ) Effective July 1, 2021, Florida law requires businesses making remote sales into the state to collect and electronically remit sales and use tax, including any applicable discretionary sales Florida Dept of Revenue Florida Sales and Use Taxpurpose, I must pay tax on the purchase price directly to the Florida Department of Revenue I understand that if I fraudulently issue this Certificate to evade payment of sales tax, I will be liable for payment of the sales tax, plus a penalty of 200% of the tax, and may be subject to conviction of a third degree felonyFlorida Department Of RevenueSales and Use Tax Information for Manufacturers Publication 203 (06/16) Important Rate Changes! • Manitowoc County begins January 1, 2025 • Milwaukee County tax increases January 1, 2024 City of Milwaukee tax begins January 1, 2024 D Direct Pay Permits Pub 203 Sales and Use Tax Information for Manufacturers

.jpg)

US sales and use tax in a nutshell KPMG

The use tax imposes a tax equal in amount to the sales tax that would have been imposed on the sale of the For example, manufacturers in many jurisdictions are allowed to purchase equipment used in the manufacturing process exempt 2020年1月15日 In Florida, the purchase of machinery and equipment is usually subject to sales or use tax However, there may be exceptions (called exemptions) that allow a purchaser not to pay sales or use tax on the FLORIDA SALES AND USE TAX ON MACHINERY§ 105‑16413 Retail sales and use tax The sale at retail and the use, storage, or consumption in this State of the following items are specifically exempted from the tax imposed by this Article: Agricultural Group (1) Repealed by Session Laws 2013‑316, s 33(b), effective July 1, 2014, and applicable to sales made on or after that datePart 3 Exemptions and Exclusions North Carolina General 2017年8月16日 The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process Ohio Revenue Code Ann 573902(B)(42)(g) provides an Ohio sales tax exemption Ohio Sales Tax Exemption for Manufacturing Agile

Manufacturing Exemptions Texas Comptroller of Public Accounts

Quick Links Forms Form 01339 (back), Texas Sales and Use Tax Exemption Certificate (PDF) Publications 94116 – Real Property Repair and Remodeling 94104 – Film, Video and Audio Production Companies and Broadcasting Companies Laws Sec 151009 – Tangible Personal Property Sec 151318 – Property Used in Manufacturing Rules Rule 3287 – Exemption 2020年2月12日 In order to take advantage of the Mississippi sales tax exemption for manufacturing, qualifying manufacturers must fill out, sign, and send to the state Mississippi Sales Tax Form 721518 “Direct Pay Permit Application” which can be found at the Mississippi Department of Revenue website Once the state approves the Direct Pay Permit, Mississippi Sales Tax Exemption for Manufacturing AgileConn Gen Stat §12412(18) and §12412(34) are the original manufacturing sales and use taxes exemptions and together form the foundation of available manufacturing exemptions under the Sales and Use Taxes Act They provide manufacturers a full exemption from sales and use taxes on the purchase of machinery, materials, tools and fuel used IP 9918 Sales and Use Taxes Guide for Manufacturers Fabricators 2017年8月9日 Sales and Use Tax TAA 17A013 Manufacturing Exemptions Question: Taxpayer is in seeking a determination whether the parts and repairs referenced below are exempt from Floridasales and use tax under the provisions of s 21208(7)(XX), fS, pertaining to the repair of qualifying industrial machinery and equipment Answers: Taxpayer is a qualifying Sales and Use Tax TAA 17A013 Manufacturing Exemptions

.jpg)

Michigan Sales Tax Exemption for Manufacturing

2020年11月16日 Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing Michigan defines industrial processing as “the activity of converting or conditioning tangible personal property by changing the form, composition, quality, combination or character of property for ultimate sale at retail or for use in the manufacturing 2023年2月28日 The application for industrial machinery authorization can be found here Upon receipt of the Industrial Machinery Exemption certificate, a manufacturer may purchase industrial machinery and some services exempt from sales or use tax The qualified manufacturer will also qualify for reduced sales tax rates or total exemption on the purchase of SUT80 Industrial Machinery Exemption for Manufacturers23VAC10210920 Manufacturing and processing A Generally The retail sales and use tax does not apply to the following types of tangible personal property when used or consumed by an industrial manufacturer or processor of products for sale or resale: (As used in this section, the terms "manufacturing and processing" include "converting")23VAC10210920 Manufacturing and processing Virginia LawIn the state of California, between the dates of July 1, 2014, and July 1, 2022, an exemption will be made applicable to the gross receipts from the sale, storage, use, or other consumption in California of certain qualified tangible personal property, which includes machinery and equipment, which has been purchased for use by certain qualified persons to be used Are Manufacturing and Machinery taxable in California?

Sales Use Tax Incentives Alabama Department of Revenue

Sales and Use Tax Exemptions Pollution Control Equipment: Equipment or materials purchased primarily for the control, reduction, or elimination of air or water pollution are exempt from sales and use tax under Alabama law (Sections 40234(a)(16) and 402362(3)); Raw Materials: Tangible personal property used by manufacturers or compounders as an ingredient or 2022年4月26日 Again, the amount you will pay in taxes depends on your property’s assessed value and the purpose of the land You will either pay $300 or $250 per $100,000 of assessed value per year for property tax in Do you pay property tax on vacant land in Ontario?North Carolina does not levy a sales and use tax on repairs to industrial machinery or service contracts for mill machinery Electricity, Fuel and Natural Gas, Sales and Use Tax Exemption Retail sales, as well as the use, storage or consumption of electricity, fuel and piped natural gas sold to a manufacturer are exempt from sales and use tax for use in a manufacturing operationTax Other Cost Savings NC CommerceLearn about Land Transfer Tax and NonResident Speculation TaxThis online book has multiple pages Please click on the Table of Contents link above for additional information related to this topicInformationCanada Post strikeVisit ontarioca/mail to learn about impacted programs and potential delaysHelp us improve your online experienceTake a 2minute survey and tell us Frequently Asked Questions about Land Transfer Tax

Consumer Use Tax: WHAT MANUFACTURERS NEED TO KNOW

3 Consumer Use Tax: What Manufacturers Need to Know Consumer use tax is also due when consumers make a purchase in jurisdictions with a lower rate of tax than the rate where the goods will be used For example, if you have a business in Boston that regularly purchases office supplies in sales taxfree Nashua, NH, you owe Boston’s 625%2021年12月6日 (6) A person processing food for sale is a manufacturer and may claim a sales or use tax exemption on purchases of equipment and other taxable items that qualify for exemption under Tax Code, §151318 For example, a restaurant may claim an exemption on the purchase of an oven or a mixer directly used in baking or mixingManufacturing Sales Tax Exemptions: Making the Case2023年12月21日 Pay an assessment notice You can pay a land tax assessment notice by credit card, BPAY or via AutoPay Instalments If the options of paying at a Westpac branch or in person at Australia Post outlets are listed on your assessment you can also pay by those methods You can set up a payment plan to pay your assessment by instalments via our online selfservice Pay your land tax assessment State Revenue Office2024年9月19日 This guide includes general information about the Massachusetts sales and use tax It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law This also includes a general listing of items that are exempt from the Massachusetts sales and use tax This guide is not designed to address all questions Sales and Use Tax Massgov

Tennessee Sales Tax Exemption for Manufacturing sales and use tax

2019年11月20日 The second option is for Tennessee manufacturers to bypass the state’s approval and fill out a Streamlined Sales Tax SSTGB Form F0003 “Streamlined Sales and Use Tax Agreement Certificate of Exemption” That form can be sent directly to the manufacturer’s vendors to avoid sales taxes being charged on tax exempt items