Accounting for selling mining equipment

Financial Reporting in the Global Mining Industry IAS Plus

Our findings are based on a review of the published annual financial statements and supplementary data of twentyone of the world’s leading mining companies These companies 2024年6月28日 Explore essential accounting practices tailored for the mining industry, ensuring accurate financial management and strategic decisionmaking Accounting practices in the Accounting Practices for the Mining Industry: A Comprehensive mining industry The International Accounting Standards Board (IASB) has formed an Extractive Activities working group; however, formal guidance on many issues facing mining companies Financial reporting in the mining industry* PwCWelcome to KPMG’s series of mining industry accounting thought leadership, IFRS for Mining These publications are focused on topical accounting issues and designed to provide finance IFRS for mining KPMG

.jpg)

Property, Plant and Equipment IAS 16 IFRS

In May 2020, the Board issued Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16) which prohibit a company from deducting from the cost of property, Mining entities use different financing methods including structured transactions which involve selling future production from specified properties to a thirdparty “investor” for cash This cash In depth A look at current financial reporting issues PwCAccounting Policies, Changes in Accounting Estimates and Errors Paragraphs 11 and 12 of IAS 8 specify sources of authoritative requirements and guidance that management is required to Mineral Resources Exploration for and Evaluation of IFRSFrom a mining company’s perspective, given the risk that post sales commodity price swings could reverse revenue recognised under the current accounting guidance, application of the IFRS industry insights: Mining sector IAS Plus

VIEWPOINTS: Applying IFRS® Standards in the Mining Industry

Accountants of Canada (CPA Canada) and the Prospectors Developers Association of Canada (PDAC) created the Mining Industry Task Force on IFRS Standards (Task Force) to share AARD emerged from the Boart Longyear group – responsible for designing and manufacturing its first hydraulic rock drill in the early 1980s Under the management of an experienced team, AARD has built a comprehensive Home Aard Mining Equipmentas a change in an accounting estimate in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors Impairment IAS 36 Impairment of Assets is applied in determining whether an item of property, plant and equipment is impaired and the determination of its recoverable amount DerecognitionIAS 16 PROPERTY, PLANT AND EQUIPMENT Grant ThorntonAccounting for leases There are a number of changes to lease accounting applying the requirements of IFRS 16, those resulting in specific implementation issues for the mining industry are covered within this publication The key changes include: Lease accounting Lease definition Lease and non lease components Mining services contractsIFRS for mining KPMG

Financial reporting in the mining industry* PwC

mining industry, who are often faced with alternative accounting practices; investors and other users of mining industry financial statements, so they can identify some of the accounting practices adopted to reflect unusual features unique to the industry; and accounting bodies, standardsetting agencies and governments throughout the worldIFRS industry insights: Mining sector IFRS 15, the new revenue Standard could impact profile of revenue and profit recognition Headlines • The profile of revenue and profit recognition may change for certain mining companies as the new revenue Standard is more detailed and more prescriptive than the existing guidance andIFRS industry insights: Mining sector IAS Plus2024年5月15日 Accounting Fundamentals in Mining and Metals Exploration and evaluation expenditures in the mining and metals industry pose unique accounting challenges During the exploration phase, companies assess the presence of mineral reserves These preliminary expenses are often considered an aspect of research and, therefore, frequently expensed as How do mining and metals companies account for exploration In April 2001 the International Accounting Standards Board (Board) adopted IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993IAS 16 Property, Plant and Equipment replaced IAS 16 Accounting for Property, Plant and Equipment (issued in March 1982)IAS 16 that was issued in March IAS 16 Property, Plant and Equipment IFRS

IFRS and the mining industry IAS Plus

top ten accounting issues 1 Impairment The impairment guidance in IAS 36 Impairment of Assets applies to Property, Plant and Equipment (PPE), goodwill and intangibles and involves significant estimation complexities for mining companies It also applies to joint venture interests and equity accounted investments IASThe objective of this Standard is to prescribe the accounting treatment for property, plant and equipment so that users [Refer: Conceptual Framework paragraphs 12110 and 236] of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment The principal issues in accounting for International Accounting Standard 16 Property, Plant and Equipment 2024年4月30日 I analyzed US public companies with significant Bitcoin mining operations to determine the accounting policies these companies apply, The useful life of mining equipment “ The Company’s treasury strategy is to cover its operating costs through the selling of digital assets earned from its revenue activitiesAccounting Policies of US Bitcoin Mining Companies Substack2024年3月8日 Over the past decades in Australia, the mining industry has embraced a wealth of new technology, procedures and Personal Protective Equipment (PPE) This has helped to reduce the rate of workplace accidents Personal Protective Equipment (PPE) for Mining RS

.jpg)

12 Accounting for capital projects Viewpoint

2024年2月22日 Generally, costs incurred for replacements or betterments of property, plant, and equipment can be capitalized when they extend the life or increase the functionality of the asset in question; otherwise, they should be expensed as incurred (eg, repairs and maintenance) See PPE 14 for information on accounting for maintenance costsAccounting for Certain Costs and Activities Related to Property, Plant, and Equipment reflect current practice regarding the accounting treatment for the capitalization of costs for capital projects In 2003, the FinREC redeliberated and submitted a proposed Statement of Position to the FASB for approval (herein referred to as the unissued PPE Property, plant, equipment and other assets ViewpointSalvage value is a critical concept in accounting and financial planning, representing the estimated residual value of an asset at the end of its useful life Accurately determining the salvage value is essential for calculating depreciation, understanding the total cost of ownership, and making informed financial decisions about asset purchases and disposalsSalvage Value A Complete Guide for Businesses DeskeraBasics of US Mining Accounting Introduction Have you ever been to a mine site? a) Yes PwC b) No 5 Basics of US Mining Accounting Stages of Mine Operations PwC 6 • Depreciation of processing plant and other equipment used in mining and processing ore • Light and power, heat and all other indirect costs of running the2012 Americas School of Mines PwC

.jpg)

Accounting for sale and leaseback transactions

2020年7月1日 ILLUSTRATION OF A FAILED SALE AND LEASEBACK Smith Corp's option to purchase the building at the end of year 5 precludes treating the transfer of the asset as a sale under Paragraph 84240253 (assuming the narrow exception provided by subparagraphs a and b are not met) In this case, the transaction does not qualify as a sale and leaseback, and IAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 2003 and applies to IAS 16 — Property, Plant and Equipment2024年6月21日 In this article, we explore the world of mining rights and the accounting for mining rights in Namibia Through a detailed example, we’ll show you the entire process—from acquiring a mining right to selling it—complete with all the necessary journal entries to you a clear and practical understanding of how to get it rightHow to Account for Mining Rights in Namibia: A Practical GuideIAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 2003 and applies to IAS 16 — Property, Plant and Equipment

.jpg)

Accounting for Mining (#261) — AccountingTools

2020年4月22日 In this podcast episode, we discuss some aspects of the accounting for mining Key points made are noted below Mine Exploration Activities One issue with the accounting for mining is that a mine operator first has to engage in exploration activities in order to even figure out where to develop a mineThe objective of this Standard is to prescribe the accounting treatment for property, plant and equipment so that users [Refer: Conceptual Framework paragraphs 12110 and 236] of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment The principal issues in accounting for International Accounting Standard 16 Property, Plant and Equipment 2024年8月6日 This guide aims to demystify the various components of equipment rental accounting, offering insights into best practices and regulatory requirements Key Principles of Equipment Rental Accounting Effective equipment rental accounting begins with a robust system for tracking prehensive Guide to Equipment Rental Accounting Practices2024年5月14日 Problem 1 Multinational Company was organized in January 2022 with an authorized share capital of P10,000,000 consisting of 100,000 shares of P100 par value In February, the entity acquired a tract of resource land at a cost of P3,000,000 which was paid in cash Also, the entity purchased for cash a mining equipment of P800,000 This equipment will Accounting for Depletion and Mining Equipment: Problems

.jpg)

Mining Equipment Jobs, Employment in =remote Indeed

104 Mining Equipment jobs available in =remote on Indeed Apply to General Counsel, Sales Representative, Construction Equipment Sales Representative and more!According to FASB (Financial Accounting Standards Board) – “A saleleaseback transaction involving real estate, including real estate with equipment, must qualify as a sale under the provisions of FASB Statement No 66, Accounting for Sales of Real Estate, as amended by this Statement, before it is appropriate for the sellerlessee to account for the transaction as a saleEquipment Sale Leaseback Viking Equipment FinanceIn May 2020, the International Accounting Standards Board (IASB) amended IAS 16 Property, Plant and Equipment to prohibit an entity from deducting from the cost of property, plant and equipment (PPE) amounts received from selling items produced while the company is preparing the asset for its intended useIAS 16: Property, Plant and Equipment – Proceeds before 2016年1月29日 Thank you for finally writing an article on the issues of the revised standard accounting pitfalls of the mining sector where revisions should be extended to the 43101 feasibility study which is How To Properly Use Cost Reporting In The Mining Industry

About the Property, plant, equipment and other assets guide

2024年8月31日 PPE 826 was updated to remove guidance on ASC 840 since ASC 842 is now effective for all companies; Example PPE 84 was updated to clarify the accounting for a claim for an unusual incident not included in the projected in IBNR; Example PPE 810 was updated to clarify that an upfront payment made to conduct RD which represents an advanced payment IAS 16 Property, Plant and Equipment sets out the requirements for the recognition of the assets, the determination of their carrying amounts, and the depreciation charges and impairment losses in relation to them This page provides information on the standard, alongside ICAEW factsheetsIAS 16 Property, Plant and Equipment ICAEWAustralian Accounting Standard AASB 116 Property, Plant and Equipment (as amended) is set out in paragraphs 1 – Aus832 and Appendices A – B All the paragraphs have equal authority Paragraphs in bold type state the main principles AASB 116 is to be read in the context of other Australian Accounting Standards, including AASB 1048Property, Plant and Equipment Australian Accounting 2019年10月21日 Miners may deduct the cost of their mining equipment from their ordinary mining income If the mining equipment exceeds $1 million in costs, the taxpayer may need to use the modified accelerated cost recovery system IRS Guidance On Cryptocurrency Mining Taxes Taxbit

.jpg)

Cryptocurrency Accounting Ryan Wingate

2022年5月8日 Purchasing Crypto Debit Credit Bitcoin Asset Account $10,000 Cash Account $10,000 Selling cryptocurrency works in the opposite If the market value later recovers to \$600K, under the intangible asset accounting rules, the value on the balance sheet must stay at Credit your Mining Income Account and Debit the Crypto Asset Mining sector Clearly IFRS Industry insights for IFRS 15 New revenue Standard could impact profile of revenue and profit recognition What’s happened? The International Accounting Standards Board (IASB) has published a new Standard, IFRS 15 Revenue from Contracts with Customers (‘the new Standard’)Mining sector Clearly IFRS Deloitte United States2024年8月19日 Equipment can be both an asset and a liability in business accounting Learn how to classify it properly on your balance sheetIs Equipment a Business Asset? businessnewsdailyEarthmovers Excavators is your onestop marketplace to buy and sell earthmoving, construction, mining and quarrying equipment Choose from one of the advertising options below and sell your new, used or secondhand excavator, site dumper, loader, dozer, truck, mini excavator or other construction machinery quickly and easily with TradeEarthmoversSell Your Earthmoving, Construction Mining Equipment

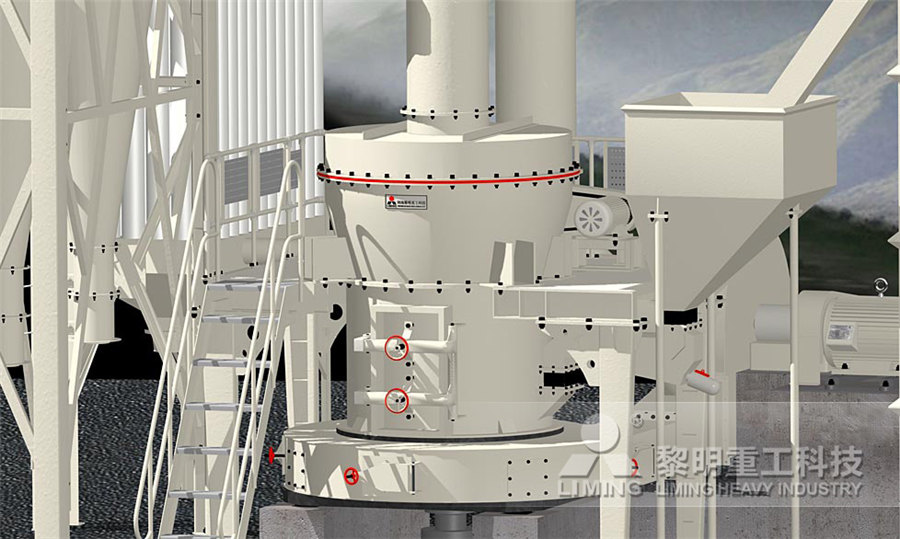

CFB石灰石脱硫剂制备——磨机公众号12.8 推送案例(8)53.jpg)

MINING Equipment for Sale

Mining Equipment For Sale: 281 Mining Equipment Near Me Find New and Used Mining Equipment on Equipment Trader Equipment Trader Home; Find Equipment ; Find Equipment Rent Sell My Equipment Blog Dealers Menu Find a dealer Dealers Login as a Dealer Advertise Your Equipment Inventory2021年11月1日 This publication contains an illustrative set of consolidated financial statements for Good Mining (International) Limited (Good Mining) and its subsidiaries (the Group) that is prepared in accordance with International Financial Reporting Standards (IFRS) The Group is a fictitious, large publicly listed mining companyGood Mining (International) LimitedFind Mining Equipment For Sale or Lease including Trucks, Dozers, Loaders, Crushers, Underground, Conveyors, Mills, Drills, Sixtymile River Claims Yukon Canada in the historic Klondike Gold Rush mining district Patented Lode Claim The Boundary Red Mountain Mine Located in Whatcom County, Washington, USA For SaleMining Equipment For Sale MineListingsBid on South Africa Mining Equipment Construction, Mining and Farming in our surplus auctions Register free and start bidding today across more than 500 categoriesMining Equipment for Sale in South Africa AllSurplus

.jpg)

A goldmining company expects to sell 10,000 ounces Accounting

A goldmining company expects to sell 10,000 ounces of gold 6 months from today The revenue risk of selling the gold can be hedged by Learn Accounting ≡ MENU