HOME→How much tax rate is calculated for the stone sales of industrial grinding machine manufacturers

How much tax rate is calculated for the stone sales of industrial grinding machine manufacturers

Import Duty Calculator SimplyDuty

Calculate import duty and taxes in the webbased calculator It's fast and free to try and covers over 100 destinations worldwide2024年7月28日 Get to grips with our sales tax calculator effortlessly and understand how much tax is added to your purchases or how much a product costs before tax Just follow these Sales Tax Calculator2024年2月11日 Use these tips to learn how to calculate sales tax on your retail purchases Multiply the cost of an item or service by the sales tax in order to 5 Ways to Calculate Sales Tax wikiHow2024年10月30日 Sales tax can be calculated by converting the sales tax percentage to a decimal, and then multiplying it by the retail price of a good or service Calculating sales tax is simple asHow to Calculate Sales Tax, With Examples Investopedia

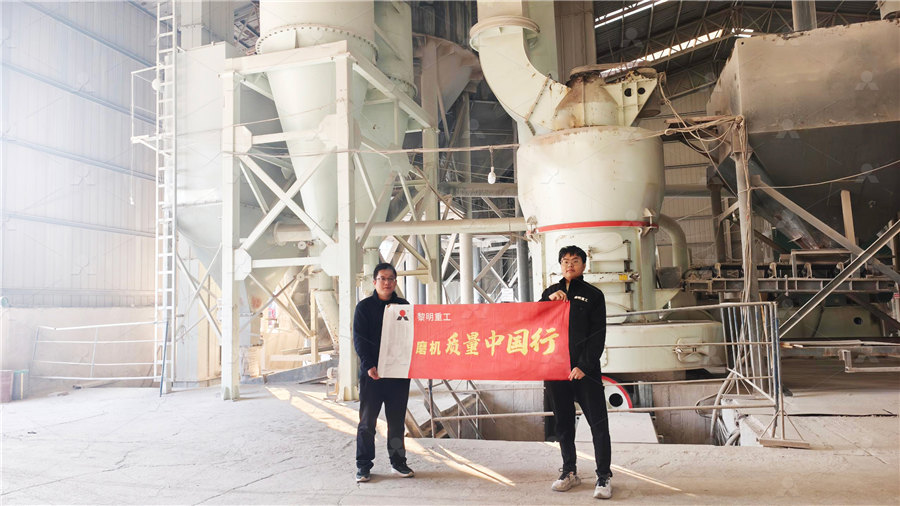

CFB石灰石脱硫剂制备——磨机公众号12.8 推送案例(8)53.jpg)

Business Sales Tax Calculations FAQ Avalara

Do I charge the tax rate of the state I’m in or the state I’m selling to? How do I find the right tax rate? If I only use a sales tax rate calculator, what else should I be aware of? Do I have to 2023年11月21日 To calculate the sales tax in dollars, simply multiply the purchase price by the sales tax rate For example, to compute the total price for a $25000 television if it's being purchasedHow to Calculate Sales Tax? Methods Examples2016年10月1日 Use this calculator to find out the amount of tax that applies to sales in Canada Enter the amount charged for a purchase before all applicable sales taxes, including the GST/HST calculator (and rates) CanadacaStarting 1 January 2023, 200% of eligible RD expenses are taxdeductible For intangible assets formed from these expenses, tax amortization is based on 200% of their cost From 1 January Chinese tax system Santandertrade

.jpg)

Sales Tax Calculator

Free calculator to find the sales tax amount/rate, before tax price, and aftertax such as wholesalers, distributors, suppliers, manufacturers, and retailers, will usually need to pay VAT, not just the end consumer, as is done with US sales tax VAT can be calculated as the sales price minus the costs of materials or parts used that have All you need to do is enter your state, and your city or county to find the right rate for you Download sales tax lookup tool→ Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale Sales tax = total value of sale x sales tax rateSales Tax Calculator and Rate Lookup 2021 Wise2023年3月3日 Why Calculate the Machine Hour Rate? The machine hour rate is computed to recover or absorb factory overheads This basis for the recovery of overheads is adopted in industrial concerns where most of the work is driven Calculating the Machine Hour Rate Finance Strategists2024年9月3日 Budget 2024 Update FM Nirmala Sitharaman has made two announcements for those opting for the new tax regime First, the standard deduction for salaried employees is proposed to be increased from Rs 50,000/to Rs 75,000/Similarly, deduction on family pension for pensioners is proposed to be enhanced from Rs 15,000/to Rs 25,000/ Second, in the How to Calculate Income Tax on Salary with Examples?

.jpg)

Vehicle tax rates: Cars registered on or after 1 April 2017 GOVUK

2015年4月1日 Tables showing the rates for vehicle tax for different types of vehicle Vehicle tax rates: Cars registered on or after 1 April 2017 GOVUK Cookies on GOVUK2024年7月28日 Table of contents How to use the sales tax calculator Sales tax definition Sales tax vs valueadded tax (VAT) History of the sales tax How to calculate sales tax with our online sales tax calculator Sales tax in the United States Economic implications Combined State and Local Sales Tax Rates Sales tax by states in 2024 Sales tax deduction Behind the scenes of Sales Tax Calculator2024年6月6日 Sales tax example: If you bought a pair of shoes for $100 in California, where the sales tax is just over 7%, you’d owe around $7 in sales tax, making your total purchase around $107 ($100 x 0 Sales Tax: What It Is, Rates, Calculator NerdWallet2023年3月22日 The CVD rate is calculated as a percentage of the assessable value of the goods plus the basic customs duty Step 5: Calculate Education Cess and Other Charges Education cess is a surcharge levied on the total customs duty payable It is calculated at a rate of 2% of the total customs duty payableHow to Calculate Customs Duty on Imported Goods in India Tax

.jpg)

How to Calculate Sales Tax Definition, Formula, Example

2022年12月19日 Arizona has a state sales tax of 56%, Maricopa County has a county sales tax rate of 07%, and Scottsdale has a city sales tax rate of 175% (2023) Once you know the sales tax rate you need to collect at, use the sales tax formula 2024年2月11日 To figure out sales tax on an item, you’ll need to know your local sales tax rate You can easily find this information by searching online for the sales tax rate in your city and state Once you know the tax rate in your area, convert the sales tax rate from a percent to a decimal by moving the decimal point two places to the left5 Ways to Calculate Sales Tax wikiHow2024年5月10日 If you sell stock for a profit, that profit counts as income Calculate the capital gains taxes you may need to pay, or the tax advantages that may help you if you sell stocks at a lossTaxes on Selling Stock: What You Pay How to Pay 2024年5月6日 Gold prices have been touching new highs The price of 24 karat gold crossed Rs 75,000 per 10 grams to touch a lifetime high As gold becomes expensive, it is important for buyers to understand how jewellers calculate the Gold jewellery cost calculation: How jewellers calculate

.jpg)

Understanding How Tax is Calculated in Australia HR Block

The tax rates increase progressively, and you will only pay tax at a rate of 45% on the amount your earn over $190,000 in the 202425 year (this has increased from $180,000 in the 202324 year) You can view current personal income tax rates and thresholds here For example, if you earn $42,000, in the2025 year, the tax you pay will be:2024年11月22日 Therefore, depreciation rates prescribed under the Income Tax Act are only allowed irrespective of the depreciation rates charged in the books of accounts Written Down Value(WDV) of Assets Meaning As per Section 32(1) of the IT Act depreciation should be computed at the prescribed percentage on the WDV of the asset, which in turn is calculated Depreciation Rates for FY 202324 under Income Tax Act2024年2月2日 China individual income tax rate 2024 Who should pay income tax in China¹? Individuals who have a domicile in China or who do not have a residence but have resided in China for a total of 183 days in a taxable year are** resident individuals**China income tax rate for foreigners: how to calculate? WiseHer monthly tax is calculated by applying the standard rate of tax (20%) to the first €3,500 (up to the limit of Ruth's rate band) The higher rate of tax (40%) is applied to the last €100 (€3,600€3,500) of her income above the rate bandHow your Income Tax is calculated Revenue Commissioners

.jpg)

How Is Sales Tax Calculated? (With Steps and Example)

2024年7月30日 They calculate the combined sales tax rates of the county and the state and find that the sales tax rate in Tampa is 75% The cashier also knows that the customer has purchased taxexempt food items and that the sales price for nontaxable goods is $2052024年10月30日 Because the combined amount of £29,600 is less than £37,700 (the basic rate band for the 2024 to 2025 tax year), you pay Capital Gains Tax at 10% This means you’ll pay £960 in Capital Gains TaxCapital Gains Tax: what you pay it on, rates and allowances2024年11月7日 If you want to be successful and grow your business from the ground up, it takes some serious hustling and grinding It’s a learning process, for sure! Tax Rate Single Filer Married, Filing Jointly Married, Filing Separately Head of Household 10% $0–11,000 $0–22,000How to Calculate Taxes for Your Business Ramsey0% 3% 6% 9% 12% State Local Sales Taxes (2021) Median household income and taxes State local sales taxes average Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United StatesSales tax is governed at the state level and no national general sales tax exists 45 states, the District of Columbia, the territories of Puerto Rico, and Sales taxes in the United States Wikipedia

Taxes on Stocks: How They Work, When to Pay

2024年7月19日 Learn how dividends and capital gains on stock sales can affect your tax bill, The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing statusTo find out how much you'll need to pay, you'll need to check the commodity code for umbrellas, and apply the import duty rate for that code — 65% Tax will be due on the cost of the goods without shipping, which in this case is $28,000 Customs Duty Rates in US: How to Calculate Import Plant and Machinery Depreciation Rate as per the Income Tax Act Depreciation is discussed under Section 32 of the Income Tax Act, 1961 As per the Income Tax Act, deductions for deprecation are applicable for both tangible and non Plant and Machinery Depreciation Rate: Calculation 2020年2月15日 Hence, IGST must be calculated after adding the applicable customs duty to the value of imported goods Find the GST rate along with GST Compensation Cess If for any imported articles, in addition to basic customs duty, other duty of customs is chargeable, then it must be included along with the basic customs duty to arrive at the value on which GST cess IGST on Imports Calculation Methodology IndiaFilings

.jpg)

How we calculate your PAYG instalment amount or rate

2024年9月17日 (Estimated (notional) tax ÷ instalment income) × 100 Reasonable instalment rates If the calculated rate is more than the highest income tax rate for your entity type, we will automatically reduce it to a more reasonable rate (see Reasonable instalment rates table) The adjusted rate will appear on your activity statement6 天之前 The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37% Your bracket depends on your taxable income and filing status2024 and 2025 Tax Brackets and Federal Income Tax Rates2020年3月19日 Total Sales Tax = Item Cost x Sales Tax Rate = 60 x 75% = 60 x 0075How to Calculate Sales Tax? The Complete Guide ProPakistaniSecurities Transaction Tax (STT) is a tax on buying and selling stocks and other securities on Indian stock exchanges As per the NSE circular (PDF) the STT charges are revised from 1st October 2024 STT for various types of orders are:Securities Transaction Tax (STT): Rates and how to calculate it

How to Calculate Import Tax and Duty in the Philippines

2024年2月5日 Taxes include ValueAdded Tax (VAT), Excise Tax, PaymentAd Valorem Tax, Warehouse Processing Charges (WPC), and Bulk and BreakBulk Cargo fees How are import duties and taxes calculated? Calculations are based on the Cost, Insurance, and Freight (CIF) value, with VAT at 12% and duty rates between 065%2021年5月5日 Because the abrasives are placed on the surface to do the finishing process with much more accuracy The grinding machine is widely used to finish the workpiece Do you know why? Because the work removal rate is low between 025 to 05 mm (This can be advantages or disadvantages also for various types of works)Grinding Machine: Definition, Parts, Working Principle, Operation 2021年10月21日 A sales tax is one that applies to the purchase of goods and services It’s a type of consumption tax, meaning it taxes people for spending money It’s also a type of indirect tax, which means Sales Tax: Definition, How It Works, How To VAT is a multistage tax levied on the value added at each stage of production of goods and services Any person who makes an annual turnover of more than Rs5 Lakhs by supplying goods and services is supposed to register for VAT paymentVAT And Sales Tax Calculation Formula in India BankBazaar

Calculating Land Transfer Tax Ontarioca

2017年1月1日 Transitional tax rates The following rates of land transfer tax apply to all registrations and dispositions that occur prior to January 1, 2017 Tax is calculated on the value of the consideration at the following rates: amounts up to and including $55,000: 05%; amounts exceeding $55,000, up to and including $250,000: 10%The United States imposes a tax on the profits of US resident corporations at a rate of 21 percent (reduced from 35 percent by the 2017 Tax Cuts and Jobs Act) The corporate income tax raised $4247 billion in fiscal year 2022, accounting for 87 percent of How does the corporate income tax work? Tax Policy Center2 天之前 The amendment to Finance Bill 2024 announced the restoration of indexation benefits on immovable property purchased before 23rd July 2024 for individuals and HUFs only for the purpose of computing tax In other words, individuals can now choose between a 125% tax rate without an indexation benefit and a 20% tax rate with an indexation benefitCapital Gain Tax On Sale Of Property2024年6月5日 Tax rates for Australian residents for income years from 2025 back to 1984 ATO Community; Legal Database; What's New; Log in to online services Log in Log in to ATO online services Access our secure services If you use myGovID, its name is changing to myID but you’ll use it the same wayTax rates – Australian resident Australian Taxation Office

Corporation Tax rates and allowances GOVUK

2024年4月4日 Corporation Tax rates If an asset is acquired before 1 January 2018, but disposed of on of after that date, the Indexation Allowance will be calculated using either the:Sales tax = total amount of sale x sales tax rate (in this case 8%) Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you needNew York City Sales Tax Rate and Calculator 2021 Wise2024年6月7日 Click here to know how it is calculated, at fixed rate or in percentage File Now Products INDIVIDUAL PRODUCTS GST G1G9 filing ASP/GSP solution gold sales reach their peak The making charges of gold jewellery are one of the main there isn’t any drastic variation as common factors such as taxes and purity determine Gold Making Charges: How to Calculate Making Charges on Gold?2023年10月31日 For example, if an owner of a coal mine earned $200,000, they could claim a depletion deduction of $20,000 with a 10% depletion rate ($200,000 x 01) for the year Is depletion an operating expense? Cost depletion allocates the costs of extracting natural resources and those costs are recorded as operating expenses to lower pretax incomeHow to calculate depletion expense Tax Accounting Blog